Getting Started With Market Data

Coin Metrics Market Data Feed provides access to historical and real-time data from the world’s leading spot and derivatives crypto exchanges. We offer all of the fundamental market-related data types including tick-by-tick trades, quotes, order book snapshots, candles, and more.

The example charts showcased in this notebook are presented on a weekly basis in our State of the Market newsletter.

Resources

This notebook demonstrates basic functionality offered by the Coin Metrics Python API Client and Market Data Feed.

Coin Metrics offers a vast assortment of data for hundreds of cryptoassets. The Python API Client allows for easy access to this data using Python without needing to create your own wrappers using requests and other such libraries.

To understand the data that Coin Metrics offers, feel free to peruse the resources below.

The Coin Metrics API v4 website contains the full set of endpoints and data offered by Coin Metrics.

The Coin Metrics Product Docs gives detailed, conceptual explanations of the data that Coin Metrics offers.

The Python API Client Spec contains a full list of functions..

Setup

Reference Data/Catalog Endpoints

The catalog endpoints display the set of data available to your API key. The catalog-all endpoints display the full set of data for our data set.

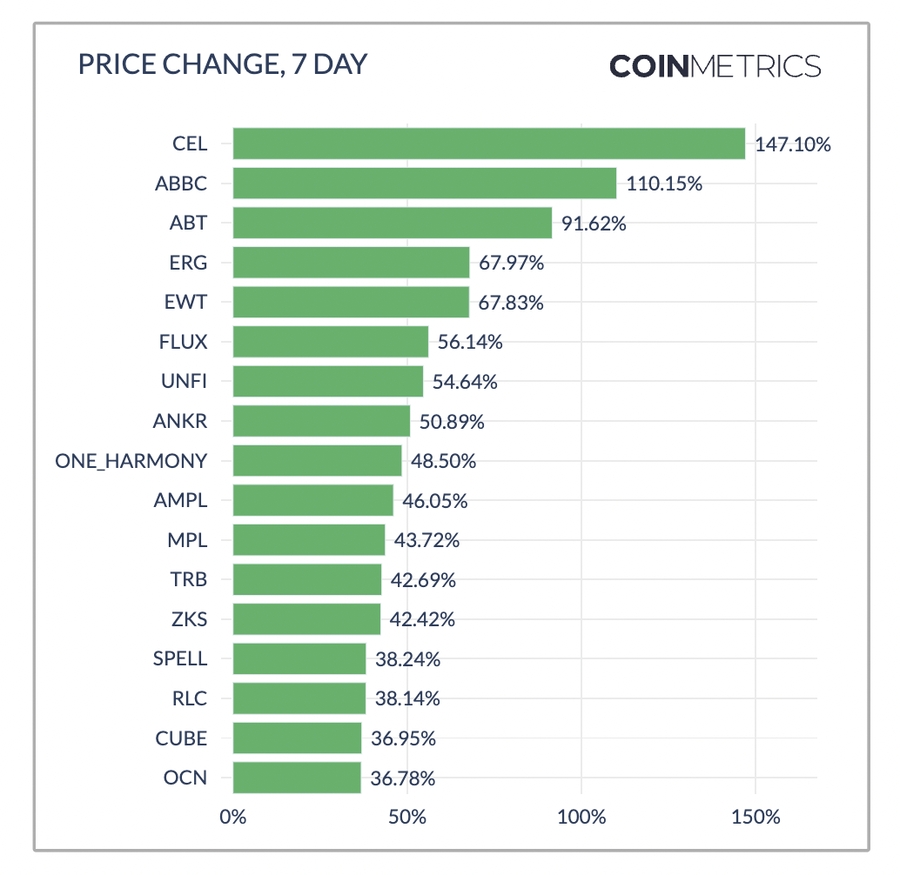

Example 1: Returns by coin in the CM Reference Rates universe

We offer reference rates quoted in USD, Euro, Bitcoin, and Ethereum. We now support these quote currencies for our entire reference rates coverage universe which can be found on coverage.coinmetrics.io

Fig. 1 - 7 Day Price Change chart from State of the Market

We can retrieve Reference Rates from the get_asset_metrics endpoint. The code snippets below demonstrate how to do this with a small list of assets.

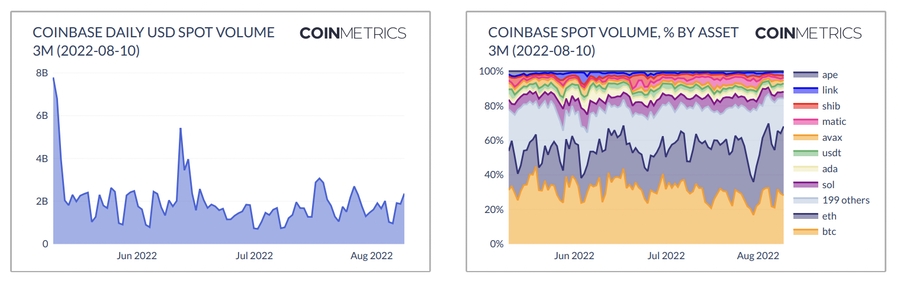

Example 2: Spot trading volume on Coinbase

Fig. 2 - Coinbase daily spot volume breakdown from State of the Market

Foundational Data Types - Trades

Trades are one of the foundational data types we collect from exchanges. From raw trades data, we can construct additional aggregated metrics.

Spot Volume Share - Candles Data

From raw trades data, we construct OHLC candles for each market. For our Spot Volume % by Asset chart, we derive volume from our get_market_candles endpoint.

All of our endpoints that accept the markets parameter will accept wildcards like exchange-* or exchange-*-spot or *USDT-future. The wildcards will match any market which fits this pattern so users do not need to specify every individual market when querying data for multiple markets.

price_open: The opening price of the candle.

price_high: The high price of the candle.

price_low: The low price of the candle.

price_close: The close price of the candle.

vwap: The volume-weighted average price of the candle.

volume: The volume of the candle in units of the base asset.

candle_usd_volume: The volume of the candle in units of U.S. dollars.

candle_trades_count: The number of trades in the candle interval.

Total Exchange Spot Volume - Exchange Metrics

We can retrieve the overall volume on the exchange using our exchange_metrics endpoint.

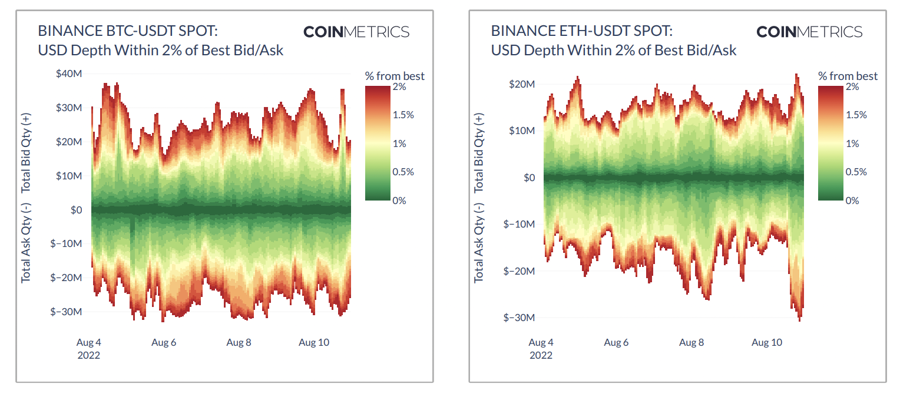

Example 3: Spot order book depth

Fig. 3 - Binance order book depth from State of the Market

Foundational Data Types - Order Book Snapshots

Exchange order book data is one of the most foundational data types in the crypto industry— arguably, even more foundational than trades data, as two orders must be matched for a trade to occur. Order book data is useful for various entities, including market makers, systematic or quantitative traders, and funds studying trade execution patterns.

Coin Metrics stores three types of order book snapshots. One type consists of a snapshot of the top 100 bids and top 100 asks taken once every 10 seconds for major markets. The second type consists of a full order book snapshot (every bid and every ask) taken once every hour for all markets. The third is a snapshot where the price is +/-10% of mid-price taken once every 10 seconds. All of these snapshots are served through our /timeseries/market-orderbooks endpoint.

Market Quotes - Best Bid & Asks

As an added convenience, we also serve the top bid/ask via a separate timeseries/market-quotes endpoint. Quotes are derived from our order book snapshots, so they are available at the same 10s intervals.

Note: We now also offer every quote update via the new Coin Metrics flat file application.

Example 4: Futures data types

We offer futures data for 3,000+ markets across top derivatives trading venues such as Binance, CME, FTX, BitMEX, Huobi, Bybit, etc. Supported data types include liquidations, contract prices, open interest, candles, volume, funding rates, and more.

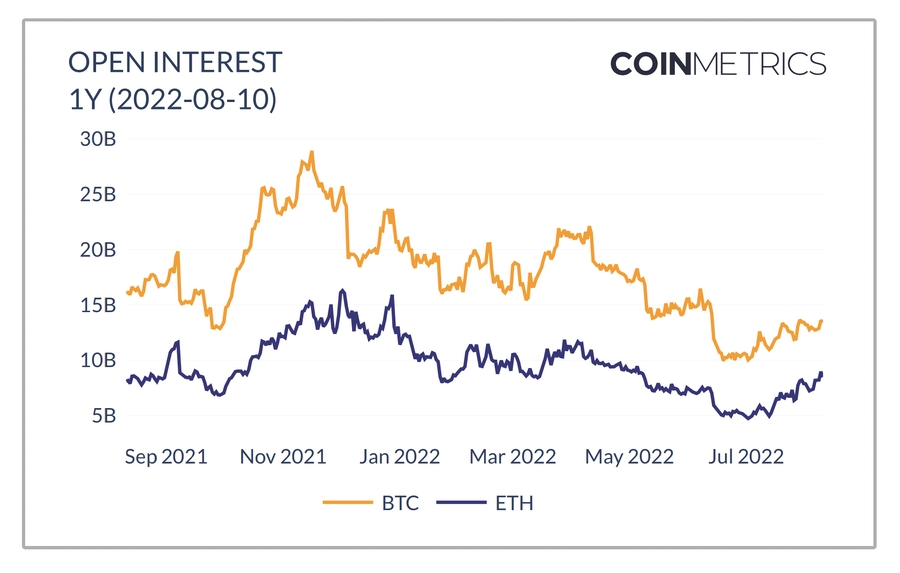

Fig. 4 - Bitcoin and Ethereum futures open interest from State of the Market

Market Open Interest - Total Contracts Outstanding

Open interest represents the number of contracts that are currently outstanding and not settled for a specific derivatives market.

Aggregated Open Interest - Daily by Asset & Contract Type

In addition to querying open interest for specific markets/contracts, the get_asset_metrics endpoint can also be used to retrieve aggregated open interest. Our reported future open interest metric is an aggregation of the reported future open interest from all futures exchanges in CM"s coverage universe.

We offer aggregated futures open interest for the following futures contract types:

Reported Future Open Interest

Reported Perpetual Future Open Interest

Reported Non-Perpetual Future Open Interest

Reported Coin-Margined Future Open Interest

Reported Tether-Margined Future Open Interest

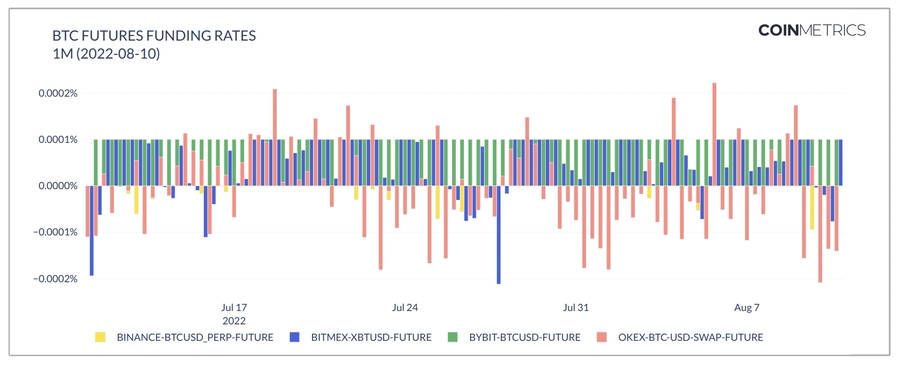

Perpetual Futures Funding Rates

Funding rates are a mechanism that exchanges use to ensure that perpetual futures trade at a price that is close to the price of the underlying spot markets. The funding rate is used to calculate the funding fee which long position holders pay short position holders, or vice versa, as a way to incentivize market participants to take positions that keep perpetual futures prices close to the underlying.

Fig. 5 - Bitcoin perpetual futures funding rates from State of the Market

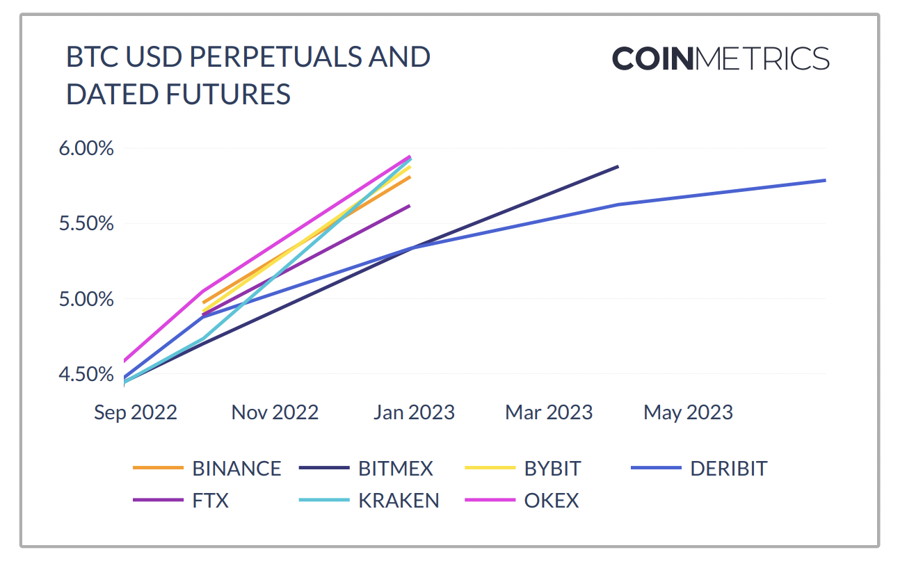

Futures Basis Metrics - Aggregated by Exchange-Asset

The basis is the annualized percent difference between the price of a theoretical futures contract and the price of its underlying spot market. Coin Metrics calculates this for several exchange-assets such as binance-btc and ftx-eth. We calculate four basis metrics at defined days to expiration: 30 day, 60 day, 90 day, and 120 day.

Fig. 6 - Bitcoin futures basis from State of the Market

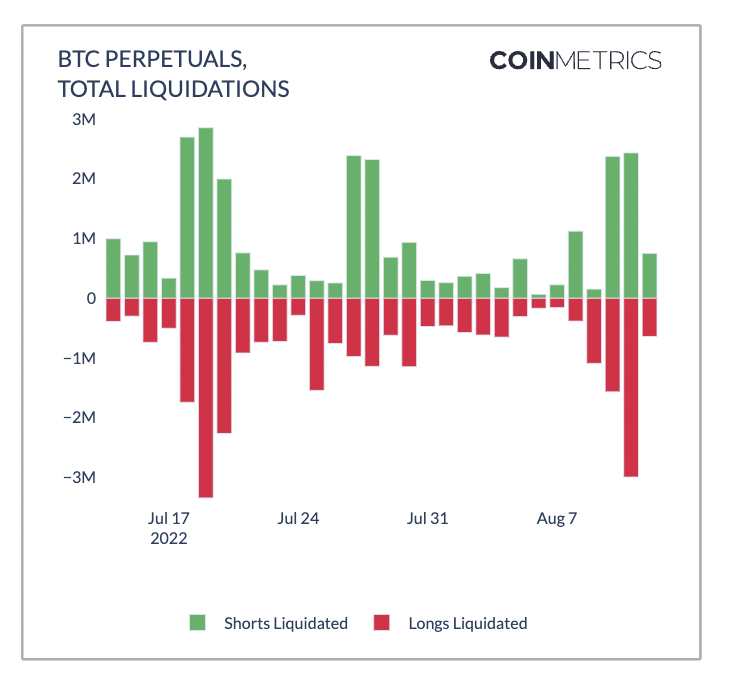

Futures Liquidations - Individual Orders/Trades

Exchanges which offer futures markets utilize a risk management system that will attempt to close a user’s position before the point at which the user begins to owe more than what is in the user"s account. The trade or order that closes the user"s position is referred to as a liquidation.

Some exchanges report liquidations orders in which they will report the creation of a liquidation order when a trader’s position initially enters liquidation. When a trader’s position enters liquidation, an exchange will typically enter a limit order at the trader"s bankruptcy price. The order will show the amount of the position that is being liquidated and the liquidation price, but will not represent the matched trades that are executed as a result of the liquidation.

Other exchanges will report liquidation trades which represent the actual matched trades as a result of a liquidation order but will not report liquidation orders.

Some exchanges will report both liquidation orders and liquidation trades.

Futures Liquidations - Aggregated Daily or Hourly

Fig. 7 - Bitcoin perpetual futures liquidations from State of the Market

Example 5: Options data types

We offer options data from two of the most liquid options trading venues, Deribit and OKX. Supported data types include implied volatility, trades, open interest, contract prices, contract specifications, quotes, and greeks. We recently expanded our options coverage to include several new data types from Deribit and added several new API endpoints to serve this data.

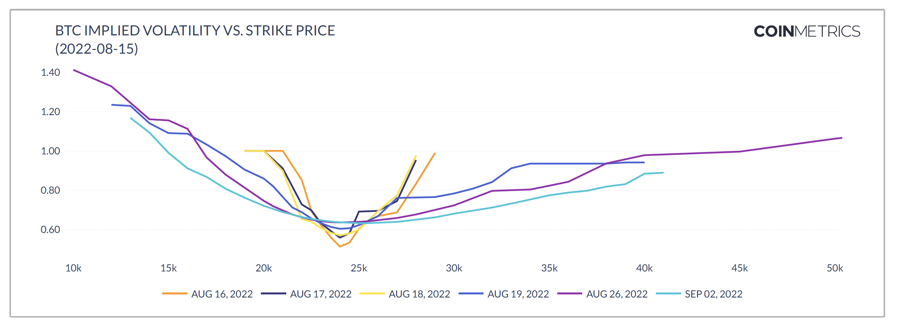

Options Contracts - Implied Volatility

Fig. 8 - Bitcoin "Volatility Smile" from State of the Market

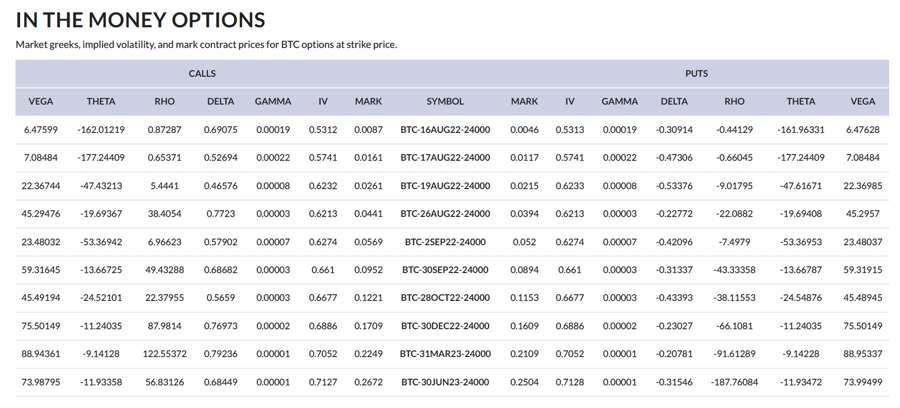

Options Contracts - Market Greeks

Fig. 9 - Option Chain from State of the Market

Options Contracts - Market Quotes

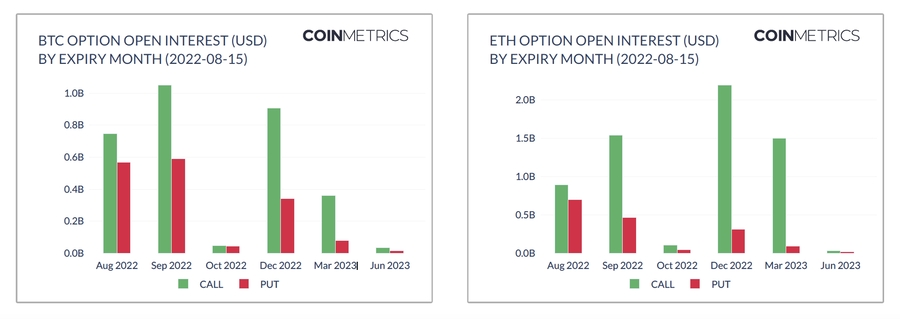

Options Contracts - Market Open Interest

Fig. 10 - Option Open Interest from State of the Market

Last updated

Was this helpful?